Authority drops benami attachment order of I-T Income Tax Department against Shah Rukh Khan

Authority drops benami attachment order of I-T Income Tax Department against Shah Rukh Khan

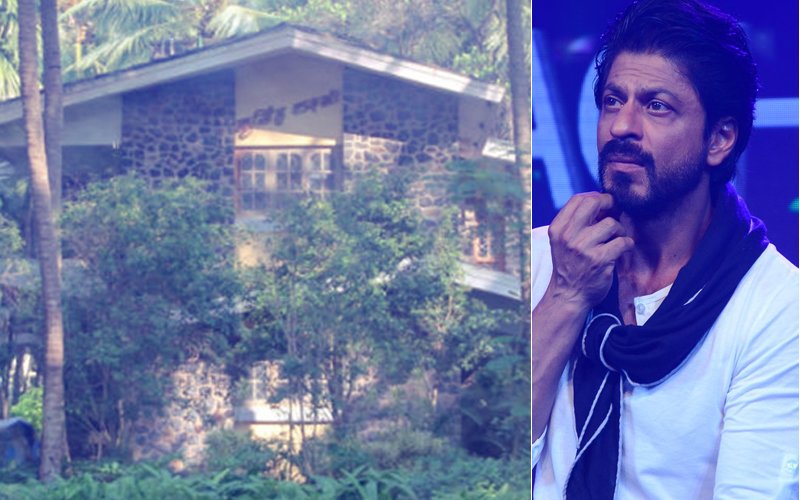

NEW DELHI: Actor Shah Rukh Khan has been absolved of the charge of being a beneficiary of a benami property in the scenic beach town of Alibaug in Maharashtra as an Appellate Authority under the law has “revoked” the attachment order of the I-T Department, calling it baseless and coloured.nnThe Adjudicating Authority (AA) slammed the income tax department authority for issuing the order against Khan and a company– in which he, his wife Gauri Khan and in-laws are shareholders– in February last year, saying a “commerical transaction entered into course of business by an independent entity cannot be coloured as benami transaction because it had sourced the funds from loans.”nnA division bench of the AA comprising D Singhai (Chairperson) and Member (Law) Tushar V Shah exonerated Khan and said: “We have come to the conclusion that the named properties, ie, agriculture land at village Thal, Taluka Alibaug bearing survey nos 188/A, 188/1B, 188/2, 188/3, 188/4, 187/1 and structure thereon are not a benami property and hence the attachment made thereof by the investigating officer is revoked hereby.”nnThe tax department had attached the farm house and plot, built on an agricultural land, in Alibaug, worth about Rs 15 crore, and had called the company-Ms Deja Vu Farms Pvt Ltd- a benamidar (in whose name benami property is standing) and the 53-year-old actor a beneficiary (who pays money consideration) of a benami deal booked under the Prohibition of Benami Property Transaction Act.nnThe 1988 enacted law was implemented by the Modi government from November, 2016 with a strong impetus, saying it was aimed to crack down against black money and stash holders.nnThe AA bench, in the order accessed by PTI, also rapped the probe officer of the I-T Department in Mumbai for seemingly relying on “some press report/online articles” that Khan acquired the property for his benefit, which it said was “incorrect and impermissible in law.”nn”There is no basis to conclude that the property acquired by Deja Vu Farms Pvt Ltd is held for immediate or future benefit, direct or indirect of Shah Rukh Khan,” the January, 23 issued order said.nnThe Authority rejected the I-T Department’s allegation that the entire transaction of purchasing the land parcels in Alibaug and construction of a luxury farmhouse on it was done on the “desire and instruction”of Khan and from “unsecured loans” of about Rs 14.67 crore provided by him to the firm.nnThe I-T had also charged that as Khan was “not an agriculturist, he sought to purchase the land by forming Ms Deja Vu Farms Pvt Ltd, a front entity and giving it the colour of company engaged in agriculture.”nnThe department had also said in its order that a person Moreshwar Rajaram Ajgaonkar was a “front” of Khan as the the actor used the former’s credentials of being an agriculturist to purchase the land by making a representation under the said category before the Additional Collector of Raigad, the district under which Alibaug falls.nnIt had also charged that the company was incorporated “on the instructions” of Khan as he was interested in purchasing a property in Alibaug for construction of a farmhouse.nnThe taxman had said in its complaint that the objective of the firm (Deja Vu) was stated to undertake agricultural activity on the land and the Raigad district state government gave permission to purchase the land with a “condition” that it will be put to use within 3 years for the purposes of farming.nnThe AA also found as “justified” the contention of Khan and his company that a private firm can borrow funds even from its shareholders and that there has been no concealment of the loan given by the actor which has been “disclosed” by the former in its annual returns for the last several years.nnThe Authority said that it was “beyond doubt” that the Alibaug property was acquired and held by the company in its own right and independent of any other person.nn”There is nothing to raise the inference or presumption in law that the property owned by a company can be said to be held for the benefit of its shareholder,” the Authority ruled, absolving Khan of the criminal charges under the stringent law.nnAs per the anti-benami law, once proven, a benamidar (in whose name benami property is standing) and beneficiary (who pay money consideration) are prosecutable and may face rigorous imprisonment up to 7 years besides being liable to pay fine up to 25 per cent of fair market value of benami property.nn nnSource: Press Trust of India