India’s GST revenues grow 15 per cent to nearly Rs 1.50 lakh crore in December

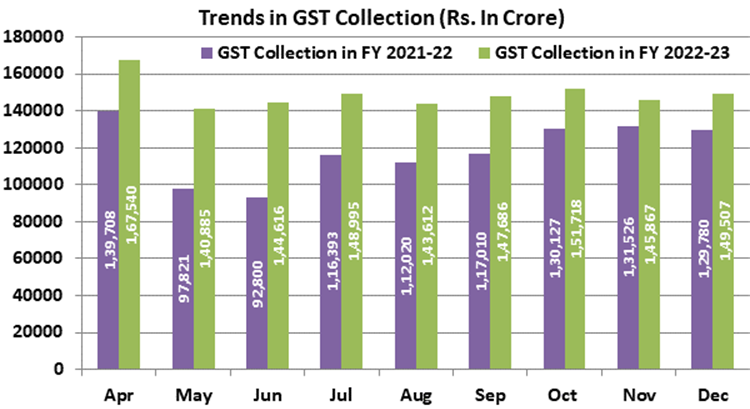

NEW DELHI: The collections from Goods and Services Tax (GST) grew by 15 per cent to over Rs 1.49 lakh crore in December 2022, indicating improved manufacturing output and consumption demand, besides better compliance.

This is the 10th month in a row that the revenues have remained above the Rs 1.4 lakh crore mark. The collection in November was about Rs 1.46 lakh crore. “The gross GST revenue collected during December 2022 is Rs 1,49,507 crore, of which CGST is Rs 26,711 crore, SGST is Rs 33,357 crore, IGST is Rs 78,434 crore (including Rs 40,263 crore collected on import of goods) and Cess is Rs 11,005 crore (including Rs 850 crore collected on import of goods),” the India’s finance ministry said in a statement.

The revenues for December 2022 are 15 per cent higher than the GST collection in the same month last year, which itself was close to Rs 1.30 lakh crore. During the month, revenues from the import of goods were 8 per cent higher, and the revenues from the domestic transaction (including the import of services) are 18 per cent more than the revenues from these sources during the same month last year.

In November 2022, 7.9 crore e-way bills were generated, which was significantly higher than the 7.6 crore e-way bill issued in October 2022.

Deloitte India Partner MS Mani said, “An 18 per cent increase in the GST revenues from domestic transactions viewed with the increase in e-way bill issuance and the significant increase in GST collections by key manufacturer and consuming states, would be indicative of a sustained manufacturing and consumption cycle across recent months”.

NA Shah Associates Partner Parag Mehta said the tax authorities have been able to track down tax evaders/non-compliers with the assistance of a strong GSTN platform. “Normally, even the trend shows more collections in the last 3-4 months due to the department becoming more aggressive and the business trying to achieve their budgeted targets,” Mehta added.

KPMG Partner Indirect Tax Abhishek Jain said Rs 1.5 lakh crore monthly collection seems to be the new normal even after peak festive sales are over. Revenues from GST touched a record of about Rs 1.68 lakh crore in April. In May, the collection was about Rs 1.41 lakh crore, June (Rs 1.45 lakh crore), July (Rs 1.49 lakh crore), August (Rs 1.44 lakh crore), September (Rs 1.48 lakh crore), October (Rs 1.52 lakh crore), November (Rs 1.46 lakh crore) and December (Rs 1.49 lakh crore).

State-wise growth of GST Revenues (Rs crore) during December 2022[1]

| State | Dec-21 | Dec-22 | Growth | |

| 1 | Jammu and Kashmir | 320 | 410 | 28% |

| 2 | Himachal Pradesh | 662 | 708 | 7% |

| 3 | Punjab | 1,573 | 1,734 | 10% |

| 4 | Chandigarh | 164 | 218 | 33% |

| 5 | Uttarakhand | 1,077 | 1,253 | 16% |

| 6 | Haryana | 5,873 | 6,678 | 14% |

| 7 | Delhi | 3,754 | 4,401 | 17% |

| 8 | Rajasthan | 3,058 | 3,789 | 24% |

| 9 | Uttar Pradesh | 6,029 | 7,178 | 19% |

| 10 | Bihar | 963 | 1,309 | 36% |

| 11 | Sikkim | 249 | 290 | 17% |

| 12 | Arunachal Pradesh | 53 | 67 | 27% |

| 13 | Nagaland | 34 | 44 | 30% |

| 14 | Manipur | 48 | 46 | -5% |

| 15 | Mizoram | 20 | 23 | 16% |

| 16 | Tripura | 68 | 78 | 15% |

| 17 | Meghalaya | 149 | 171 | 15% |

| 18 | Assam | 1,015 | 1,150 | 13% |

| 19 | West Bengal | 3,707 | 4,583 | 24% |

| 20 | Jharkhand | 2,206 | 2,536 | 15% |

| 21 | Odisha | 4,080 | 3,854 | -6% |

| 22 | Chhattisgarh | 2,582 | 2,585 | 0% |

| 23 | Madhya Pradesh | 2,533 | 3,079 | 22% |

| 24 | Gujarat | 7,336 | 9,238 | 26% |

| 25 | Daman and Diu | 2 | – | -86% |

| 26 | Dadra and Nagar Haveli | 232 | 317 | 37% |

| 27 | Maharashtra | 19,592 | 23,598 | 20% |

| 29 | Karnataka | 8,335 | 10,061 | 21% |

| 30 | Goa | 592 | 460 | -22% |

| 31 | Lakshadweep | 1 | 1 | -36% |

| 32 | Kerala | 1,895 | 2,185 | 15% |

| 33 | Tamil Nadu | 6,635 | 8,324 | 25% |

| 34 | Puducherry | 147 | 192 | 30% |

| 35 | Andaman and Nicobar Islands | 26 | 21 | -19% |

| 36 | Telangana | 3,760 | 4,178 | 11% |

| 37 | Andhra Pradesh | 2,532 | 3,182 | 26% |

| 38 | Ladakh | 15 | 26 | 68% |

| 97 | Other Territory | 140 | 249 | 78% |

| 99 | Center Jurisdiction | 186 | 179 | -4% |

| Grand Total | 91,639 | 1,08,394 | 18% |

With Press Trust of India Inputs